Businesses often face various compliance requirements, which makes risk assessment indispensable for continuous operation and growth. But where do you start, and how do you ensure that your efforts are effective and aligned with your business goals?

Let me help you break down the compliance risk assessment process into understandable steps, offering practical advice and insights to help you navigate this complex field.

From identifying risks to implementing strategies, I will provide a clear guide for businesses looking to strengthen their compliance practices.

Let’s begin by exploring the very definition of compliance risk assessment, which illustrates what compliance risks are, in the first place.

What Are Compliance Risks?

In the intricate landscape of corporate governance, businesses navigate through a minefield of compliance risks, each with its potential to impact operational integrity and company reputation significantly. Here are some of the most prevalent risks:

- Data Privacy and Security Breaches: With the advent of stringent data protection laws like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, safeguarding customer data has never been more critical.

Businesses must ensure robust data security measures are in place to prevent unauthorized access, data leaks, or breaches that could lead to significant fines and loss of consumer trust.

- Health and Safety Violations: Compliance with Occupational Safety and Health Administration (OSHA) standards is a must for businesses looking to protect their employees and visitors from health hazards and unsafe working conditions. Non-compliance not only endangers lives but also subjects businesses to penalties and damaging lawsuits.

- Financial Misconduct: Financial irregularities, such as fraud, embezzlement, and non-adherence to financial reporting standards, can severely damage an organization’s credibility and financial health. Regulations like the Sarbanes-Oxley Act (SOX) in the United States mandate rigorous internal controls to prevent and detect such misconduct.

- Environmental Non-Compliance: Companies operating in industries with significant environmental impacts are subject to regulations aimed at protecting natural resources and public health. Failing to comply with environmental laws can result in substantial fines, cleanup costs, and reputational damage.

- Corruption and Bribery: The Foreign Corrupt Practices Act (FCPA) in the United States and similar anti-corruption laws worldwide require businesses to implement measures to prevent bribery and corruption. Violations can lead to severe legal penalties and tarnish a company’s image.

Identifying and understanding these common compliance risks are the first steps toward developing an effective strategy to mitigate potential threats and ensure the longevity and success of your business.

What Is Compliance Risk Assessment?

A compliance risk assessment is a thorough process that organizations use to identify, analyze, and manage the risks associated with failing to comply with laws, regulations, and standards.

This crucial step helps businesses understand where they might be at risk of non-compliance and outlines measures to address these issues proactively.

An example of compliance risk assessment is analyzing a healthcare facility’s adherence to the Health Insurance Portability and Accountability Act (HIPAA) to identify gaps in patient data protection and privacy practices, ensuring measures are in place to prevent data breaches and maintain confidentiality.

By conducting a compliance risk assessment, companies can avoid legal penalties, safeguard their reputation, and ensure they operate within the boundaries of regulatory requirements, ultimately protecting their financial and operational stability.

Why Conduct a Compliance Risk Assessment: Importance & Benefits

Conducting a compliance and risk assessment is vital for any business aiming to navigate the complexities of legal and regulatory landscapes. Here’s a detailed look at why it’s essential and what benefits it delivers:

1. Preventing Legal and Financial Setbacks

Early identification of compliance issues helps your business steer clear of severe legal consequences and hefty financial penalties. It’s like having a roadmap that warns you of potential roadblocks ahead, saving you from costly detours and disruptions.

For example, if a risk assessment identifies gaps in employee knowledge about updated anti-money laundering regulations, the company would launch targeted training to ensure compliance and avoid potential fines.

2. Reinforcing Your Business Reputation

Your risk assessment and compliance efforts demonstrate to your customers, partners, and the wider market that your business prioritizes ethical practices and reliability. This commitment is crucial for building and maintaining trust, and it sets you apart as a leader in your industry.

For instance, a risk assessment might identify the need for clearer ethical guidelines for supplier interactions, enhancing the company’s reputation for responsible sourcing.

3. Optimizing Business Operations

Aligning your operational processes with compliance requirements does more than just keep you in good legal standing—it streamlines your operations, enhances efficiency, and improves overall agility. This optimization reduces operational hiccups and drives better, faster outcomes.

For example, a risk assessment might uncover inefficiencies in the onboarding process related to compliance paperwork. Streamlining this process saves time and resources while ensuring compliance.

4. Building Comprehensive Stakeholder Confidence

A proactive approach to compliance reassures all stakeholders—investors, customers, employees—that your business is secure and trustworthy. This broad-based confidence supports stronger relationships and fosters a stable business environment.

For instance, by conducting a risk assessment and implementing strong cybersecurity measures, a company demonstrates to customers that it prioritizes the protection of their data, increasing trust.

5. Facilitating Sustainable Business Growth

A robust compliance framework prepares your business for both current and future regulatory demands. It supports long-term growth by ensuring you are always prepared to adapt to changes in the compliance landscape, helping you scale sustainably without undue risk.

For example, a company expanding internationally can conduct a risk assessment to identify and proactively address potential environmental regulation challenges in the new market.

6. Strategic Risk Management and Control

Compliance risk assessments provide a strategic overview of potential risks, allowing your business to proactively address vulnerabilities before they become issues. This process involves a detailed analysis of risk impacts and the development of tailored strategies to mitigate them effectively.

By prioritizing risks based on their potential impact, you can allocate resources more efficiently and ensure that critical areas of your business receive the necessary attention.

For example, a compliance risk assessment might identify a high risk of non-compliance with anti-discrimination laws in hiring. This allows the company to prioritize training and implement robust procedures to ensure fair hiring practices.

7. Continuous Improvement and Compliance Alignment

By regularly conducting these assessments, you can continuously improve and refine your compliance strategies. This ongoing process helps to ensure that your business remains aligned with both existing and emerging regulations, minimizing gaps and ensuring a seamless adherence to industry standards.

For example, regular risk assessments can help a company identify emerging compliance risks related to new technologies and adapt its policies accordingly.

How to Conduct a Compliance Risk Assessment

Conducting a comprehensive compliance risk assessment is pivotal for organizations aiming to navigate the complex terrain of regulatory requirements successfully. This detailed process involves several critical steps, each designed to uncover, analyze, and mitigate potential compliance risks.

Step 1- Define Your Scope

Begin by pinpointing exactly what you’ll assess. This could span various departments, operations, or geographical regions of your business. A clear scope ensures no area at risk of non-compliance is missed.

Understanding the breadth of your operations, their interaction with different regulatory environments, and potential areas of vulnerability is crucial for a targeted and effective assessment.

Step 2- Explore Regulations

Dive into the regulatory requirements that impact your scoped areas. This involves researching local, national, and international laws and standards relevant to your business operations.

Staying current with regulatory changes and understanding their implications is vital. This foundational knowledge forms the basis for identifying where your business might be at risk of non-compliance.

Step 3- Identify Risks

With a solid understanding of applicable regulations, start identifying where your business might fall short. This step involves a thorough examination of your operational practices, policies, and procedures against the regulatory framework you’ve outlined.

It’s about pinpointing gaps between what the law requires and what your business does, which could range from data handling practices to workplace safety measures.

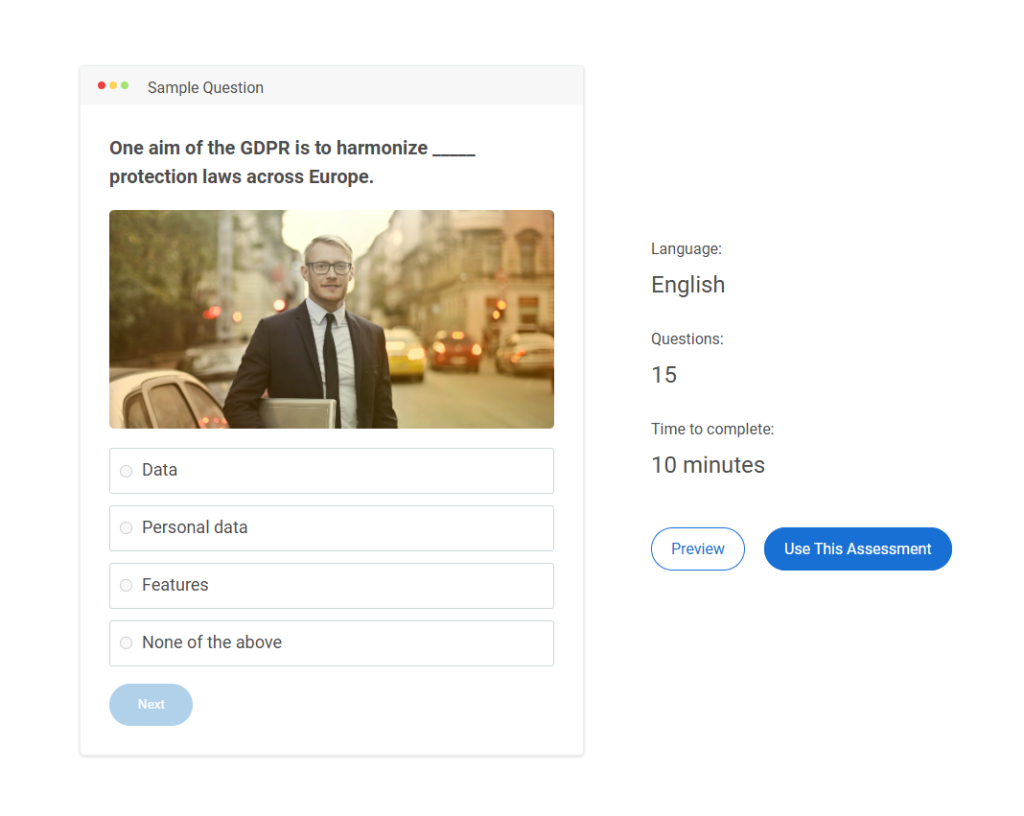

To gather this information systematically, consider using a compliance risk assessment questionnaire. This tool helps collect data from various stakeholders, ensuring all potential risks are identified and assessed.

Here are some compliance risk assessment questions you can ask in your questionnaire:

- Are all applicable regulations identified and regularly reviewed? (Yes/No)

- Does your organization have up-to-date compliance policies? (Yes/No)

- Are high-risk areas for compliance clearly identified and documented? (Yes/No)

- Do employees receive regular compliance training? (Yes/No)

- Is there a process for conducting periodic compliance audits? (Yes/No)

- Are there channels for employees to report compliance concerns anonymously? (Yes/No)

- Are third-party vendors required to comply with your organization’s standards? (Yes/No)

- Are compliance violations tracked and addressed promptly? (Yes/No)

- Does senior leadership actively oversee compliance efforts? (Yes/No)

- Are past compliance issues reviewed and used to improve policies and processes? (Yes/No)

You can also share an online assessment quiz with your employees to understand how aware they are regarding compliance matters.

You can easily create an employee compliance assessment with ProProfs Quiz Maker, which comes with a wide selection of ready-to-use compliance, skill, and psychometric assessments and is equipped with an advanced AI quiz generator that lets you convert docs into quizzes.

Watch: How to Create an Online Assessment

Step 4- Analyze & Prioritize

Once risks are identified, assess their potential impact on your business. Consider the severity of consequences for non-compliance, including financial penalties, reputational damage, and operational disruptions. Prioritizing risks allows you to focus on addressing the most critical issues first, allocating resources effectively to mitigate significant threats.

Step 5- Utilize a Risk Assessment Matrix

To effectively prioritize your identified risks, use a compliance risk assessment matrix. This tool helps you map and categorize risks based on their likelihood and potential impact.

By plotting each risk on the matrix, you can easily visualize which ones require immediate action and allocate resources accordingly. This ensures you address the most critical compliance gaps first, optimizing your mitigation efforts.

Step 6- Strategize Mitigation

Developing a plan to address each high-priority risk is your next step. This involves outlining specific actions to close compliance gaps, such as updating policies, enhancing controls, or providing targeted compliance training to employees.

Effective mitigation strategies are tailored to the nature of the risk and the operational context of your business, ensuring practical and implementable solutions.

Watch: What Is Compliance Training? Requirements & Benefits

💡Pro Tip:

You can streamline your compliance training by leveraging professionally designed, ready-to-use compliance training courses provided by employee training software, such as ProProfs Training Maker.

Step 7- Implement Solutions

Putting your mitigation plans into action is crucial. This could involve significant changes to your operational processes, adjustments to your compliance policies, or the introduction of new control measures. Successful implementation requires clear communication, adequate training for impacted employees, and the necessary resources to support changes.

Step 8- Monitor and Adjust

Compliance is a dynamic field, with regulatory changes and evolving business operations. Establish a process for ongoing monitoring of your compliance status and the effectiveness of your mitigation strategies.

Regular reviews will help you adjust your approach as needed, ensuring continuous compliance and adapting to new challenges.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!

Challenges in Compliance Risk Assessment & How to Overcome Them

Conducting compliance risk assessments presents unique challenges, but with strategic approaches, these can be effectively managed:

- Keeping Up With Regulatory Changes: Utilize regulatory technology (RegTech) solutions that offer real-time alerts on legal updates and changes. Establish a dedicated team responsible for monitoring regulatory developments and integrating them into your compliance framework.

Engaging with industry groups and attending relevant conferences can also provide insights into forthcoming changes.

- Complex Data Management: Implement a robust data management system that centralizes compliance-related data, making it easier to access and analyze. Use cloud-based solutions to enhance data storage and security. Applying data analytics can help identify compliance risks more efficiently.

- Resource Allocation: Make a compelling business case for compliance risk assessment by highlighting the potential costs of non-compliance, such as fines, legal fees, and reputational damage.

Allocate resources based on risk prioritization, focusing on areas with the highest potential impact. Consider outsourcing certain compliance functions to specialized firms to optimize costs and effectiveness.

- Employee Awareness and Adherence: Develop an ongoing education program that includes regular compliance training sessions on compliance topics relevant to different employee roles.

Use engaging content like videos and interactive quizzes to reinforce learning. Establish a culture of compliance from the top down, where leaders exemplify adherence to regulations.

Watch: How West Virginia Caring Kept Up With Compliance Requirements

Addressing these challenges requires a strategic and proactive approach, ensuring that compliance risk assessment processes are both thorough and adaptable to change.

How Much Does a Compliance Risk Assessment Cost?

The cost of a compliance risk assessment can vary significantly based on several factors, including the size and complexity of your business, the scope of the assessment, and whether you use internal resources or hire external consultants.

Factors Influencing Cost

- Business Size and Complexity: Larger organizations with more complex operations will typically have higher costs.

- Scope of the Assessment: A focused assessment of a specific department will cost less than a comprehensive organization-wide assessment.

- Internal vs. External Resources: Utilizing internal staff can be more cost-effective, but external consultants with specialized expertise may be necessary in some cases.

General Cost Considerations

While it’s impossible to provide an exact figure without specific details, it’s important to remember that the cost of non-compliance is far greater than the investment in a risk assessment. Fines, penalties, and reputational damage can far exceed the cost of proactively identifying and mitigating compliance risks.

Cost-Saving Strategies

- Prioritize high-risk areas: Focus initial assessments on areas with the highest potential impact.

- Leverage technology: Utilize compliance software and RegTech compliance risk assessment tools to automate tasks and improve efficiency.

- Develop internal expertise: Invest in training internal staff to conduct basic assessments and ongoing monitoring.

By carefully considering these factors and implementing cost-saving strategies, you can ensure your compliance risk assessment is both effective and affordable.

Ensure Compliance for Business Growth & Success

In conclusion, mastering compliance risk assessment is a critical endeavor for businesses aiming to navigate the regulatory landscape effectively. This process not only mitigates risks but also leverages compliance as a strategic asset, fostering trust, enhancing operational efficiency, and securing sustainable growth.

By diligently following the steps outlined in this post, you can ensure your business remains compliant and competitive. It would also mean that you’re embracing compliance risk assessment as an opportunity to strengthen your business foundation for future success.

Frequently Asked Questions

Neglecting compliance risk assessment can lead to legal penalties, financial losses, reputational damage, and operational disruptions. Businesses risk facing sanctions and fines, losing customer trust, and experiencing increased scrutiny from regulators and partners.

Compliance risk assessment is a crucial part of overall risk management, focusing on identifying and mitigating risks related to legal and regulatory obligations. It ensures that compliance risks are systematically identified, assessed, and managed in alignment with the organization’s overall risk management strategy.

Organizations can identify compliance risks by conducting thorough reviews of all relevant laws and regulations, engaging with key stakeholders, performing internal audits, and analyzing previous incidents of non-compliance. Staying informed about regulatory changes and industry standards is also essential.

Common challenges include keeping up with frequent regulatory changes, managing complex information across different jurisdictions, ensuring all employees are informed and compliant, and allocating adequate resources for comprehensive risk assessment and management.

A robust compliance risk assessment framework includes clear definitions of scope, thorough research on applicable regulations, a process for identifying and analyzing risks, prioritization of risks based on impact, development of mitigation strategies, and continuous monitoring and updating of the risk assessment process.

We'd love your feedback!

We'd love your feedback! Thanks for your feedback!

Thanks for your feedback!